FedNow Batch

TodayPayments.com is the trusted fintech hub for businesses, credit unions, and platforms that demand real-time payment certainty. With complete support for FedNow® and RTP® RfP batch uploads, recurring or one-time payments, and ISO 20022-compliant messaging, we bring mobile-first invoicing and digital payment workflows to life—at scale. Whether you're B2B, C2B, or subscription-based, we give you the power to fund, reconcile, and thrive in real time.

FedNow® and RTP® RfP a Batch: Upload to Any Credit Union with Confidence

![]() Real-time payments have entered a new era—one

where speed, structure, and certainty are no longer

negotiable. Whether you're a platform, credit union, or enterprise

billing partner, you need the ability to process one-time or

recurring transactions seamlessly. At TodayPayments.com,

we enable effortless import and upload of FedNow® and RTP® RfP

batch files across all credit unions and financial

institutions, using modern messaging formats and ISO 20022

compliance for unmatched reliability.

Real-time payments have entered a new era—one

where speed, structure, and certainty are no longer

negotiable. Whether you're a platform, credit union, or enterprise

billing partner, you need the ability to process one-time or

recurring transactions seamlessly. At TodayPayments.com,

we enable effortless import and upload of FedNow® and RTP® RfP

batch files across all credit unions and financial

institutions, using modern messaging formats and ISO 20022

compliance for unmatched reliability.

Processing payments in real-time shouldn’t be limited to big banks. TodayPayments.com empowers businesses to upload FedNow® and RTP® Request for Payment (RfP) batches to any credit union or financial institution across the United States.

Whether you're running:

- ✅ One-time vendor disbursements

- ✅ Recurring payroll or billing cycles

- ✅ Mass payouts for C2B or B2B operations

We support full upload functionality through a user-friendly portal or API, allowing you to send funds and reconcile transactions instantly—with every file built around ISO 20022-rich data messaging.

Batch or Single Transactions—Recurring or Real-Time? You’re Covered.

Your payment needs aren't one-size-fits-all—and your technology shouldn’t be either. Our flexible payment infrastructure enables:

- 🌀 Recurring RfPs with automatic intervals

- 💸 One-time payment requests with full remittance

- 📦 Batch uploads of 10, 100, or 100,000 payments at once

Each RfP is transmitted to the receiving credit union with structured messaging that ensures real-time credit to the recipient and full payment traceability.

Supported formats include:

- .Excel — Easy-to-manage, ideal for accounting teams

- .XML — Core banking system compatibility

- .JSON — Built for web and API-based integrations

Whether B2B, C2B, or subscription-based—you maintain certainty and control across every transaction.

Mobile, Text, and Digital Invoicing for Instant RfP Delivery

With TodayPayments.com, you can deliver Request for Payment (RfP) notifications directly to customers and partners via:

- 📲 Mobile alerts

- 💬 SMS text links

- 📧 Digital invoicing with one-click approval

Each interaction includes embedded ISO 20022-compliant remittance detail, so recipients can see what they’re paying for and your team can reconcile the payment instantly—no follow-up needed.

✅ Instant acknowledgment

✅ Clear invoice reference

✅

Seamless payment approval

✅ Certainty of

funding for every RfP

To import, upload, and download a batch of files for FedNow instant real-time payments transactions, you would typically follow a process outlined by the FedNow Service or the financial institution providing the service. Here's a general overview of the steps involved:

1. Prepare Transaction Data: Organize the transaction data you want to process into a format compatible with the FedNow Service. This could involve formatting data according to specific file formats such as CSV, XML, or JSON, depending on the requirements of the service provider.

2. Batch Creation: Create a batch file containing the transaction data. This batch file may include multiple transactions that need to be processed together.

3. Upload Batch File: Access the appropriate interface provided by the FedNow Service or your financial institution to upload the batch file. This interface could be a web portal, API, or another method specified by the service provider.

4. Validation and Processing: After uploading the batch file, the FedNow Service or your financial institution will validate the data to ensure it meets the necessary criteria and standards. If the data passes validation, the transactions will be processed in real-time.

5. Confirmation and Notifications: Once the transactions are processed, you may receive confirmation and notifications regarding the status of each transaction. This could include details such as transaction IDs, timestamps, and confirmation of successful processing.

6. Download Reports: After the transactions are processed, you may have the option to download reports or transaction logs for record-keeping and reconciliation purposes. These reports may contain details of the transactions processed, including any associated fees, timestamps, and other relevant information.

7. Data Processing Systems: Real-time bank feeds require sophisticated data processing systems that can handle large volumes of transactions and updates instantly. Banks need to ensure that their systems are capable of processing data in real-time.

8. Integration with Banking Systems: Banks must integrate their systems with FedNow formats to provide real-time feeds. This may involve implementing APIs (Application Programming Interfaces) or other integration methods to facilitate instant data exchange.

9. Security and Compliance: Banks need to ensure that real-time bank feeds comply with regulatory requirements and security standards. This includes implementing encryption, authentication, and other security measures to protect sensitive financial information.

✅ "FREE" RfP Aging & Real-Time Payments Bank Reconciliation – with all merchants process with us.

To support merchants and finance teams of all sizes, TodayPayments.com offers free downloadable templates, including:

- Aging Accounts Receivable Worksheet: Pre-built with 15, 30, 60, 90+ day tracking

- Bank Reconciliation Templates: Instantly match payments with deposits across batches

- ISO 20022 File Format Samples: Plug-and-play structures for batch uploads and RfP message testing

It's important to note that the specific steps and procedures may vary depending on the implementation of the FedNow Service by your financial institution and any additional requirements or guidelines provided by the service provider. Therefore, it's recommended to consult the documentation or support resources provided by your financial institution or the FedNow Service for detailed instructions tailored to your specific use case.

Upload Batches. Trigger Payments. Get Paid Instantly.

Why wait for slow wires or clunky ACH file processing?

At TodayPayments.com, you can:

- Upload FedNow® and RTP® RfP batches to any credit union

- Use ISO 20022-compliant files in .Excel, .XML, or .JSON

- Manage one-time or recurring payments with complete flexibility

- Deliver certainty to every vendor, customer, and recipient

⚡ Whether you're processing 10 payments or 10,000—we make real-time reconciliation your new normal.

👉 Visit TodayPayments.com today and transform how your business uploads, reconciles, and receives real-time payments with unmatched speed and accuracy.

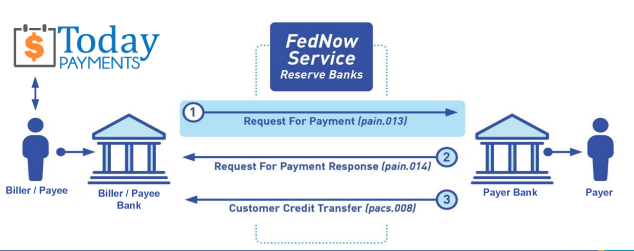

Creation Request for Payment Bank File

Call us, the .csv and or .xml Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" with Real-Time Payments to work with Billers / Payees to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", with messaging to the Debtor's (Payer's) bank.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory data for completed file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting using your Bank or Credit Union. Create Multiple Templates. Payer / Customer Routing Transit and Deposit Account Number may be required or Nickname, Alias to import with your bank. You can upload or "key data" into our software for File Creation of "Mandatory" general file.

Fees = $57 monthly, including Support Fees and Batch Fee, Monthly Fee, User Fee, Additional Payment Method on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) We add a URI for each separate Payer transaction. Using URI, per transaction, will identify and reconcile your Accounts Receivable.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create "Total" (over 600 Mandatory, Conditional & Optional fields of all ISO 20022 Pain .013) Price on quote.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Start using our Bank Reconciliation and Aging of FedNow Accounts Receivable:

Dynamic integrated with FedNow & Real-Time Payments (RtP) Bank Reconciliation: Accrual / Cash / QBO - Undeposited Funds

Contact Us for Request For Payment payment processing